Long Short-Term Memory (LSTM) networks are a special type of recurrent neural network (RNN) widely used in machine learning for regression tasks and time series forecasting. Unlike traditional neural networks, LSTMs are designed to retain information over long sequences, making them especially powerful for sequential data. If you’re interested in learning how to forecast stock prices with LSTMs, this guide is for you. In the following sections, I’ll walk you through the process of building a stock price prediction model using LSTM in Python.

Stock Price Prediction with LSTM

LSTM (Long Short-Term Memory) networks are among the most effective machine learning techniques for time series forecasting. Unlike traditional neural networks, LSTMs are designed to capture and retain patterns in sequential data over long periods. This makes them especially useful when working on problems where standard models struggle to remember past information. (You can learn more about the fundamentals of LSTMs here.)

In this section, we’ll build a stock price prediction model using LSTM in Python. To begin, we’ll start by importing the required Python libraries and fetching the latest stock price data for Apple (AAPL).

import pandas as pd

import yfinance as yf

import datetime as dt

from datetime import date, timedelta

today = date.today()d1=today.strftime("%Y-%m-%d")

end_date=d1

d2=date.today()-timedelta(days=730)

d2=d2.strftime("%Y-%m-%d")

start_date=d2

data=yf.download('AAPL',start=start_date,end=end_date,progress=False)

data["Date"]=data.index

data.columns = [col[0] if isinstance(col, tuple) else col for col in data.columns]

data=data[["Date", "Open", "High", "Low", "Close", "Volume"]]

data.reset_index(drop=True,inplace=True)

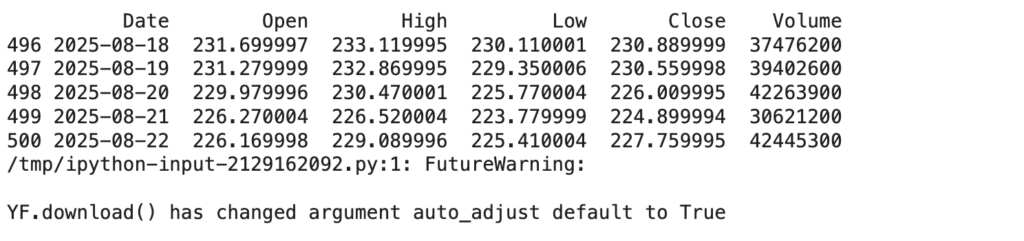

print(data.tail())

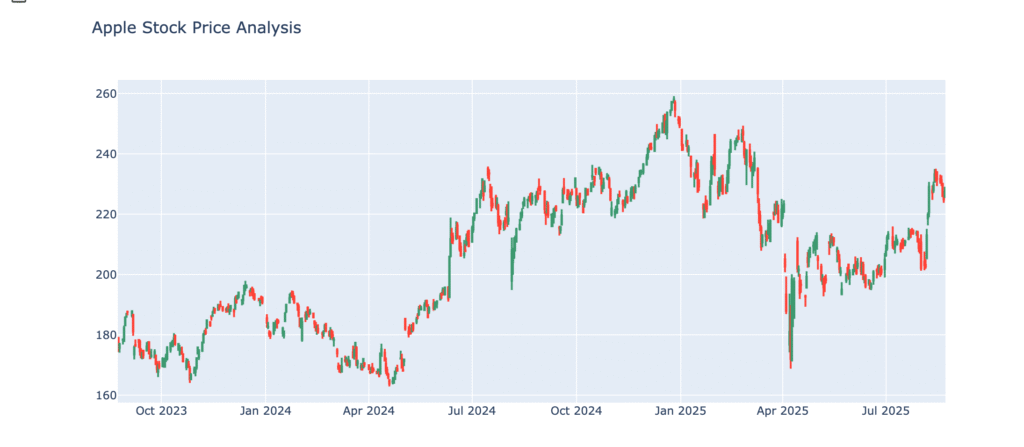

A candlestick chart provides a clear visualization of stock price movements, highlighting both rises and falls. Before moving ahead, let’s plot a candlestick chart of our data:

import plotly.graph_objects as go

figure=go.Figure(data=[go.Candlestick(x=data["Date"],

open=data["Open"],

high=data["High"],

low=data["Low"],

close=data["Close"])])

figure.update_layout(title="Apple Stock Price Analysis",

xaxis_rangeslider_visible=False)

figure.show()

Now, let’s examine how each feature correlates with the Close column, since it serves as our target variable:

correlation=data.corr()

print(correlation["Close"].sort_values(ascending=False))

Close = 1.000000 → Perfect correlation with itself.

High = 0.996681 → Very strong positive correlation with Close.

Low = 0.996173 → Also very strongly correlated with Close.

Open = 0.992290 → Strong positive correlation.

Date = 0.641060 → Moderate correlation (not as strong, but shows trend over time).

Volume = -0.179348 → Weak negative correlation (higher volume does not necessarily mean higher Close price).

Training an LSTM Model for Stock Price Prediction

Let’s begin training the LSTM model to predict stock prices. The first step is to divide the dataset into training and testing sets:

x=data[["Open", "High", "Low", "Volume"]]

y=data["Close"]

x=x.to_numpy()

y=y.to_numpy()

y=y.reshape(-1, 1)

from sklearn.model_selection import train_test_split

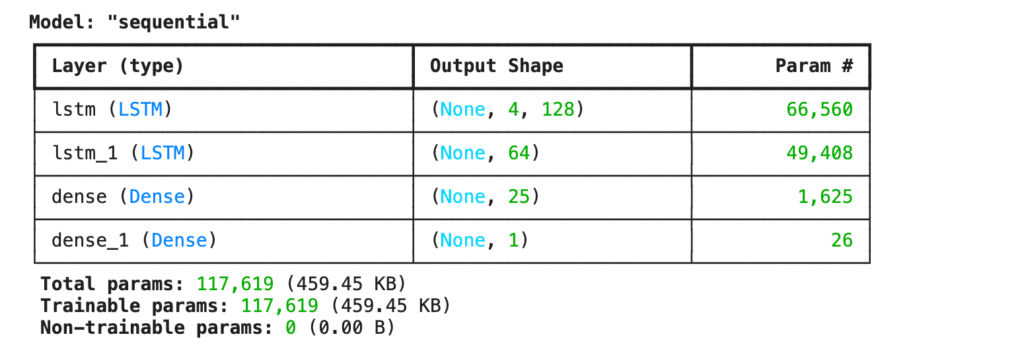

xtrain, xtest, ytrain, ytest=train_test_split(x, y, test_size=0.2, random_state=42)Next, lets design the neural network architecture for the LSTM model:

from keras.models import Sequential

from keras.layers import Dense, LSTM

model=Sequential()

model.add(LSTM(128, return_sequences=True, input_shape= (xtrain.shape[1], 1)))

model.add(LSTM(64, return_sequences=False))

model.add(Dense(25))

model.add(Dense(1))

model.summary()

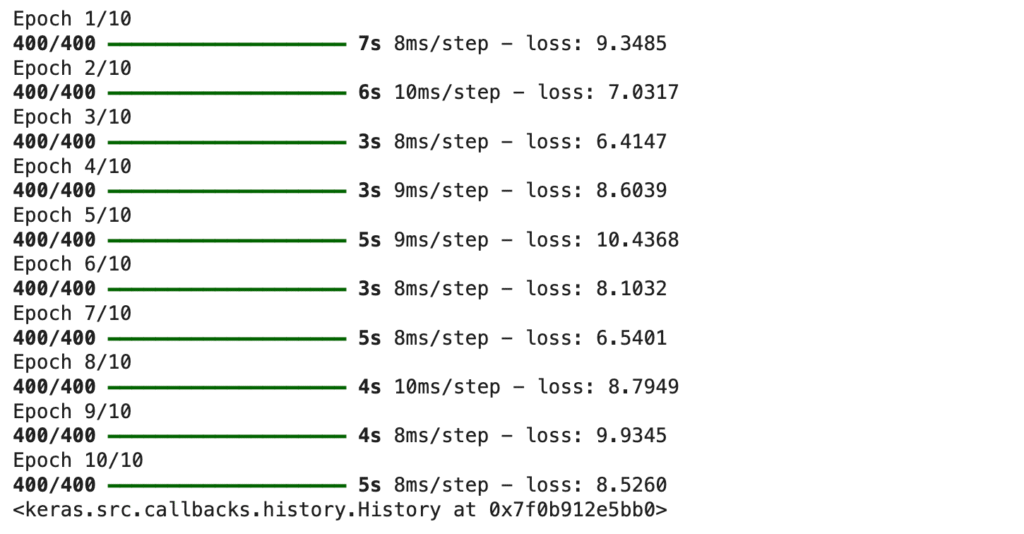

Now let’s train the neural network model for stock price prediction:

model.compile(optimizer='adam', loss='mean_squared_error')

model.fit(xtrain, ytrain, batch_size=1, epochs=10)

Next, we’ll evaluate the model by providing input values based on the same features used during training and generating the predicted output:

import numpy as np

#features=[Open, High, Low, Close, Volume]

features=np.array([[231.699997, 233.119995, 230.110001, 230.889999, 37476200]])

model.predict(features)

Explanation:

- The model predicts that the future stock price (most likely the next closing price) will be around 217.79.

- This is lower than the current “Close” input value (230.88), meaning the model expects the stock to drop.

- The value is in float32 format, which is standard for TensorFlow/Keras models.

This is how LSTM neural networks can be applied to predict stock prices.

Conclusion

In this project, we explored stock price forecasting using LSTM networks, which excel at handling sequential data and long-term dependencies. Starting with Apple’s historical stock data, we visualized trends, analyzed correlations, and trained an LSTM model to predict closing prices.

This project highlights the effectiveness of LSTMs for time series forecasting in finance, showing how past patterns can be leveraged to anticipate future stock movements.