To detect online payment fraud using machine learning, we first need to train a classification model that can distinguish between fraudulent and legitimate transactions. This requires a dataset with detailed information on past cases of online payment fraud, helping us understand the patterns and characteristics of fraudulent activities. For this project, we will use this dataset from Kaggle containing historical records of fraudulent transactions, which will serve as the basis for building and evaluating our fraud detection model. The dataset includes the following columns:

- step: represents a unit of time where 1 step equals 1 hour

- type: type of online transaction

- amount: the amount of the transaction

- nameOrig: customer starting the transaction

- oldbalanceOrg: balance before the transaction

- newbalanceOrig: balance after the transaction

- nameDest: recipient of the transaction

- oldbalanceDest: initial balance of recipient before the transaction

- newbalanceDest: the new balance of recipient after the transaction

- isFraud: fraud transaction

Online Payments Fraud Detection with Machine Learning

Let’s start by importing the necessary Python libraries and the dataset we need for this task:

import pandas as pd

import numpy as np

data=pd.read_csv("/Users/rahul_anand/Downloads/creditcard.csv")

print(data.head())

Now, let’s check whether this dataset has any null values or not:

print(data.isnull().sum())

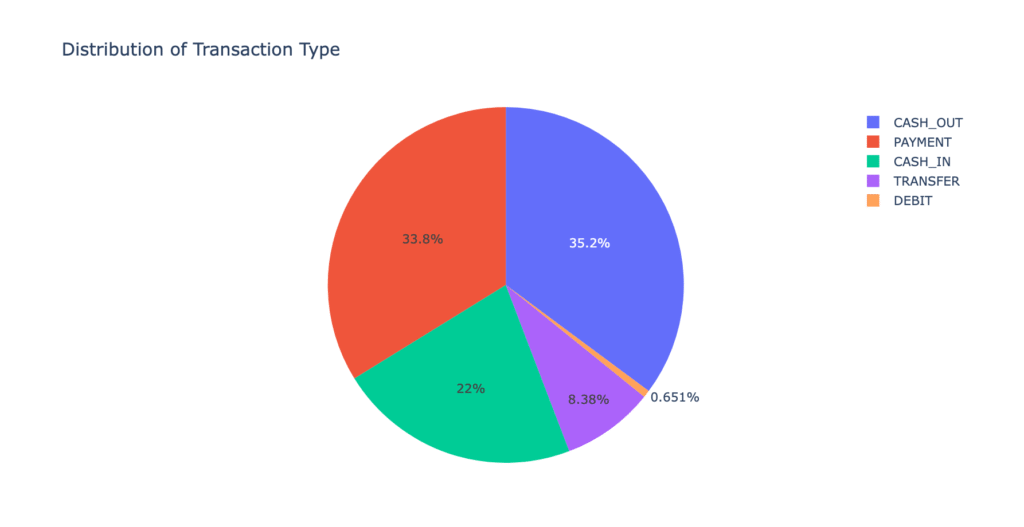

Dataset has no null values. Now, let’s check the type of transaction mentioned in the dataset:

print(data.type.value_counts())

type_counts = data["type"].value_counts()

transactions = type_counts.index

quantity = type_counts.values

import plotly.express as px

figure = px.pie(data,

values=quantity,

names=transactions,

title="Distribution of Transaction Type")

figure.show()

Now let’s explore the correlation between the features of the data with the isFraud column:

correlation=data.corr()

print(correlation["isFraud"].sort_values(ascending=False))

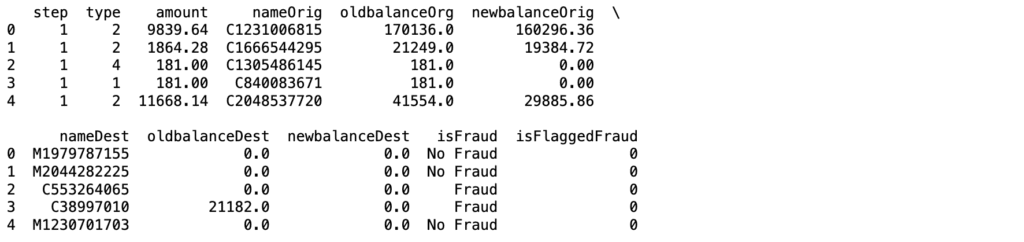

Next, we’ll convert the categorical features into numerical form. I’ll also relabel the values in the isFraud column as “No Fraud” and “Fraud” for clearer interpretation of the model’s output:

data["type"]=data["type"].map({"CASH_OUT":1, "PAYMENT":2,

"CASH_IN":3, "TRANSFER":4,

"DEBIT":5})

data["isFraud"]=data["isFraud"].map({0:"No Fraud", 1:"Fraud"})

print(data.head())

Online Payments Fraud Detection Model

Now we’ll train a classification model to distinguish between fraudulent and legitimate transactions. Before that, we’ll split the dataset into training and test sets:

from sklearn.model_selection import train_test_split

x=np.array(data[["type", "amount", "oldbalanceOrg", "newbalanceOrig"]])

y=np.array(data[["isFraud"]])Now, lets train our online payment fraud detection model:

from sklearn.tree import DecisionTreeClassifier

xtrain, xtest, ytrain, ytest=train_test_split(x, y, test_size=0.10,

random_state=42)

model=DecisionTreeClassifier()

model.fit(xtrain, ytrain)

print(model.score(xtest, ytest))![]()

Now, let’s determine whether a transaction is fraudulent by passing its details into the model:

#prediction

#features=[type, amount, oldbalanceOrg, newbalanceOrig]

features=np.array([[2, 4000, 10000, 0]])

print(model.predict(features))![]()

Conclusion

The results highlight the importance of data-driven approaches in securing digital transactions. As online payments grow, automated fraud detection systems like this are essential for reducing risks and protecting users. This workflow demonstrates the practical steps needed to build an effective fraud detection pipeline in Python.

If you’re interested in another compelling data science project, check out our Credit Score Classification: Project, deep dive into classifying credit scores using advanced machine learning techniques.